The Audit Connection Blog

How charter and tribal schools fare under public audit

Recent audits of tribal schools reflect that the schools keep records to support revenue and expenditures, and that the schools have quickly implemented audit recommendations. Recent audits of charter schools reflect that school personnel are still learning about Washington’s legal requirements. ... CONTINUE READING

In our new remote work world, are your key controls ready for audit?

As we operate in a more virtual and electronic environment, some of your control system documentation might go by the wayside. While less paper can be good, it’s important to keep some evidence of your key controls in action. ... CONTINUE READING

Areas SAO will examine in upcoming schools and ESD audits

School districts have asked the State Auditor’s Office for as much clarity as we can provide on what we plan to audit each fiscal year. Like districts, SAO relies on the Office of the Superintendent for Public Instruction for clear rules and guidance to provide the criteria for the audits. ... CONTINUE READING

Are your GAAP statements ready for prime time? Here are a few resource reminders!

As you work to wrap up your reporting year, we want to remind you about resources you might find helpful. The resources covered in this article are specifically for governments preparing statements under generally accepted accounting principles (GAAP). ... CONTINUE READING

Do you need a federal single audit for 2020 or 2021? You might for the first time! Prepare early with these 5 tips.

Federal single audits are a bit different from other types of audits, as they are compliance driven. The grantor determines which requirements you must follow, and auditor decides which of those we will audit. Our audit will evaluate and test the internal control processes you put in place over each grant requirement, as well as test that you are in compliance with it. Here are five tips to help get you started. ... CONTINUE READING

Keep the conversation going forward

Do you ever feel like you keep having the same conversations about shared projects over and over? You spend half your time just talking about the same ideas you chewed on last time with little forward progress. And now with the addition of a video conference platform, conversations can feel even more frustrating and less productive. What can you do? This article will introduce three continuous improvement tools that focus on helping a team make incremental progress. ... CONTINUE READING

Video reviews change management model

Did you know we published blog series on change management in 2020? If you did and followed along (and even if you didn’t) check out this short video that reviews the ADKAR model of change management. ... CONTINUE READING

Recently filed your 2020 annual report? Check out your data in FIT.

If you are a local government user, the Financial Intelligence Tool’s (FIT) role-based functionality allows you to access your 2020 data right now! ... CONTINUE READING

Help is on the way! Checklist for Preparing Cash Basis Financial Statements updated

We know a strong internal control system is important for accurate financial reporting. Not sure where to start? Don’t worry ― we have a tool for cash basis reporters that can help. ... CONTINUE READING

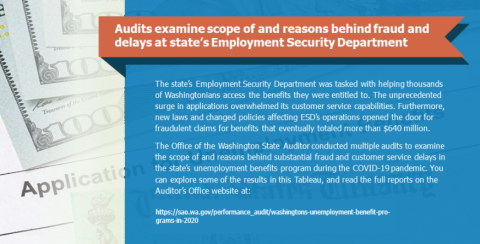

Visualizing Washington's Unemployment Benefit Programs in 2020

This presentation tells the story of Washington's Unemployment Insurance program during the COVID-19 pandemic in 2020, from the first American coronavirus patient diagnosed January 21 through the end of the year. ... CONTINUE READING