Audit timeliness is a team effort post-pandemic

Dec 20, 2023

Government offices at all levels experienced upheaval during the COVID-19 pandemic, with added complexity and disrupted timelines for all kinds of work. The scale of federal grant money to be managed – and then audited – was unprecedented. In this blog post, the Office of the Washington State Auditor explains how the increased number and size of federal grants to be audited has affected local governments’ federal single audits.

Federal grants flooded local governments, changing their audit needs

Emergency federal pandemic funding increased the number of local governments requiring federal audits. Total federal spending by local governments in Washington more than doubled, from $3.7 billion in fiscal year 2019 to $8.3 billion in fiscal year 2022. At the same time, the actual number of federal grants we were required to audit, and the amount of time we needed to audit their often very complex terms, also increased significantly.

Changing audit deadlines also affected workflow at the State Auditor’s Office

The federal government extended the deadline for completing these federal audits by six months, starting in fiscal year 2021. On the one hand, this “grace period” recognized disruptions occurring across all government organizations. But the shift in the deadline did not reduce the amount of work that still had to be completed at the end of the six-month extension.

For the State Auditor’s Office, the extended federal audit deadlines not only disrupted the normal workflow and scheduling of the local government federal audits, it also created an unprecedented workload in fiscal year 2022. Once the deadline extensions ended, it had the effect of compressing the time window for federal audits into 2022. Our auditors worked to complete the delayed audits while simultaneously conducting the audits with normal 2022 deadlines.

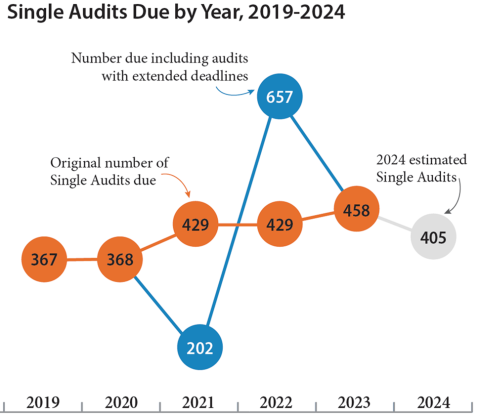

The orange line in the chart Single Audits Due by Year shows how the number of required audits grew in the pandemic, from about 368 in 2019 and 2020 to more than 425 in subsequent years. We do not expect those numbers to return to pre-pandemic levels until 2025 at the earliest. The blue line in the chart illustrates how the lag in required audits in 2021 produced a sharp spike in the number due in 2022.

How we plan to work together going forward into 2024

We always urge our clients to keep in close communication with us to maintain audit timeliness, which is an important factor in maintaining bond ratings. As governments of all sizes ride out these and other post-pandemic ripple effects, robust communication between us will be vital to achieving cost-effective and timely audits. Here are four strategies you can use to help us help you:

- Make sure we know your audit timeline needs. Your auditor can help ensure your audit is completed in time so you can provide results to others who rely on your financial statement audits. However, we can only do so if we know your deadlines. For example, does your government have bonds that require a financial statement audit, due six to nine months after your fiscal year-end? Figure out your audit timeline needs, then call or email your local audit manager to make sure we’re aware of these deadlines.

- Attend the pre-audit meetings. Before we start any audit work, we like to meet with our clients so we can discuss the timing and logistics of the upcoming audit. These meetings really help ensure we get off to a good start. We’ll also cover the benefits of performing audit work on-site at your office, and its effect on the timeliness and efficiency of the audit. It’s also the time to establish how we’ll share information, maintain commitments and ensure open communication.

- Tackle the document request list promptly. Your auditor will probably give you a list of documents that we will need for your audit. It usually includes some items we will use for planning the audit, as well as some we know we will need later. The list might appear overwhelming at first glance, so please work with your auditor to coordinate how to tackle this list.

- Attend audit status meetings. Hold these meetings with your auditor at least weekly, although they can take place more often. We use these meetings to keep you informed about the audit’s progress, and to discuss any outstanding requests, potential areas of concern and possible recommendations. And these meetings are a perfect time for you to ask questions or let us know if we need to adjust our timing or processes.

Above all, stay in touch. We are committed to forming a collaborative partnership with our clients that relies on flexibility and open communication to achieve cost-effective and timely audits.