The Audit Connection Blog

Administration of fines for human trafficking and other crimes inconsistent, audit finds

State law imposes mandatory fines on people who commit human trafficking and related sexual exploitation crimes, and it directs those funds toward local efforts to address the crimes and support survivors. However, a new performance audit by our Office found that jurisdictions in Washington are uneven in assessing, collecting and using these fines. ... CONTINUE READING

Jump-start your government’s cybersecurity program with our updated IT policy guide

IT policies are the foundation of any strong cybersecurity program, and without them, local governments are at a higher risk of security breaches and other harmful cyber incidents. Our guide is designed to help local governments create effective IT policies and jump-start their cybersecurity program. ... CONTINUE READING

State can focus more on building climate-resilient infrastructure to meet energy needs, audit finds

Washington has taken many steps to increase the development of renewable energy infrastructure, helping to mitigate the effects of climate change but these investments are increasingly vulnerable to risks associated with changing climate conditions, such as wildfires and flooding. Our Office reviewed the state’s efforts to adapt these new electricity-generating sites to future risks, and published a performance audit including detailed recommendations. ... CONTINUE READING

A quick tour through more than $20 billion in federal funds

Every year, the Office of the Washington State Auditor conducts a single audit, which examines whether state agencies spent federal funds as expected and complied with federal grant requirements. This audit helps our Office advance its mission of promoting accountability and transparency in order to increase public trust in government. ... CONTINUE READING

Staying compliant: How to manage ASB fund transfers

If your school is experiencing budget shortfalls, it’s crucial to know which funding sources are appropriate to use—and which are not. School districts have various types of revenue, some of which are restricted to certain purposes. These include federal grant awards, levy or bond proceeds and even Associated Student Body (ASB) money. It’s important that districts do not use these funds for general budget purposes. ... CONTINUE READING

Unlock these new features in SAO’s Financial Intelligence Tool (FIT)

Summer is almost here, and with longer days comes an even longer list of new features to explore in the Financial Intelligence Tool (FIT). The newest FIT update brings back fan-favorite features, including tools to better compare your government to others. We’ve also taken your feedback and introduced a clearer way to communicate your financial health indicators. Read on to discover what’s new. ... CONTINUE READING

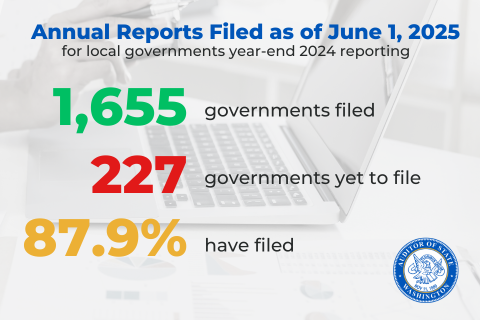

Thank you to local governments that filed their FY2024 annual reporting on time!

Our Office would like to thank every local government that filed its fiscal year 2024 annual report on time! This year, about 88 percent of local governments submitted their annual filing by June 1, 2025 (more than 1650 total), proving once again that compliance, accountability and transparency matter in Washington state. ... CONTINUE READING

Updated guide: What to know before using vendors to accept payments

Thinking about using a vendor—or even a peer-to-peer app like Venmo—to collect payments for your agency? Our updated guide walks you through what to consider before signing a contract, how to safeguard public funds and how to stay compliant with state requirements. Whether you're choosing a vendor or reviewing an existing setup, this resource can help you make informed, accountable decisions. ... CONTINUE READING

Intercepting insurance claims for unpaid child support effective, performance audit finds

In 2020, a performance audit by the Office of the Washington State Auditor recommended requiring insurance companies to report payouts for certain types of claims, so they could be matched against records of unpaid child support. A follow-up performance audit released today found that the resulting change in the law was successful – and more can be done to increase collections. ... CONTINUE READING

Small city employees exploit lack of financial controls for personal gain

A pair of small towns in Eastern Washington lost tens of thousands of tax dollars to employees who spent the money shopping online and on other unallowable purposes, the Office of the Washington State Auditor has found. ... CONTINUE READING