Note X – External Investment Pool

The External Investment Pool sponsored by the County was established in [date]. Revised Code of Washington (RCW) 36.29.022, 36.29.010, 36.29.020, authorize the County Treasurer to invest its surplus cash and any funds of municipal corporations which are not required for immediate expenditure and are in the custody or control of the county treasurer. The External Investment Pool’s investments are invested pursuant to the Revised Code of Washington. Any credits or payments to pool participants are calculated and made in a manner as required by RCW 36.29.024.

The investments are managed by the Treasurer, which reports investment activity to the County Finance Committee on a (describe timing, i.e., monthly, quarterly, etc.). Additionally, the County treasurer investment activity is subject to an annual investment policy review, compliance oversight, quarterly financial review, and annual financial reporting. The County has not provided nor obtained any legally binding guarantees during the year ended December 31, 20XX, to support the value of shares in the Pool.

The External Investment Pool is not registered with the SEC and is not subject to any formal oversight other than that provided by the County Finance Committee. The Committee is responsible for adopting investment objectives and policies, for hiring investment advisors, and for monitoring policy implementation and investment performance. The Committee’s primary role is to oversee the allocation of the Pool’s portfolio among the asset classes, investment vehicles, and investment managers.

The interest or other earnings of income from the funds of any municipal corporation of which the governing body has not taken any action pertaining to the investment of funds and that have been invested in accordance with state statutes, shall be deposited in the current expense fund of the county and may be used for general county purposes. The total amount of income from the External Investment Pool assigned to the County’s general fund for the year was $__________. These investments made by the County Treasurer on behalf of the participants is involuntary participation in the County Treasurer’s Investment Pool as they are required to be invested by statute.

(Percentage) of the County Treasurer’s Pool consists of these involuntary participants. Voluntary participants in the County Treasurer’s Pool include (describe). The deposits held for both involuntary and voluntary entities are included in the Pooled Investment Trust Fund.

The Treasurer also maintains Individual Investment Accounts, as directed by external depositors, which are invested pursuant to the Revised Code of Washington. This investment activity occurs separately from the County’s Pool and is reported in the Individual Investment Trust Fund in the amount of $__________. Income from the specific investments acquired for the individual municipalities, and changes in the value of those investments, affect only the municipality for which they are acquired, and are aggregated in the Individual Investment Fund.

Instructions to preparer:

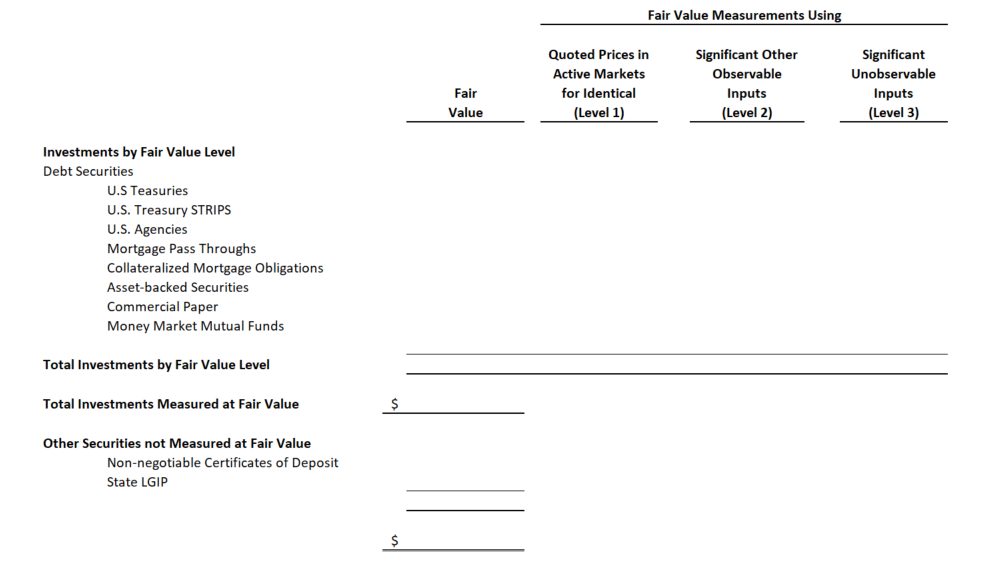

Investments are stated at fair value and are valued on a (describe basis, i.e. Monthly). The treasurer categorizes its fair value measurements within the fair value hierarchy established by generally accepted accounting principles (GAAP). Securities classified in Level 1 of the fair value hierarchy are valued using prices quoted in active markets for those securities. Securities classified in Level 2 of the fair value hierarchy are valued using other observable inputs such as matrix pricing techniques or based on quoted prices for assets in markets that are not active. Matrix pricing is used to value securities based on the securities’ relationship to benchmark quoted prices. Level 3 inputs are significant unobservable inputs. Securities are valued using the income approach such as discounted cash flow techniques. Investment in an external government investment pool is not subject to reporting within the level hierarchy.

The County treasurer has the following recurring fair value measurements as of December 31, 20XX:

[If a government external investment pool is sponsored by the County and IT DOES PUBLISH A SEPARATE ANNUAL FINANCIAL REPORT FOR THE POOL, add the required GASB 31 disclosures. The following example - placement of this portion of the note is dependent on its applicability.]

Separate financial statements for the Investment funds may be obtained from the County Treasurer’s Office, or by calling [provide telephone number].

[If a government external investment pool is sponsored by the County and IT DOES NOT PUBLISH A SEPARATE ANNUAL FINANCIAL REPORT FOR THE POOL, add the required GASB 31, as amended, disclosures. The following example - placement of this portion of the note is dependent on its applicability.]

Since a separate annual financial report on the External Investment Pool has not been, and is not planned to be, issued, the following additional disclosures are being provided in the County’s financial statements.

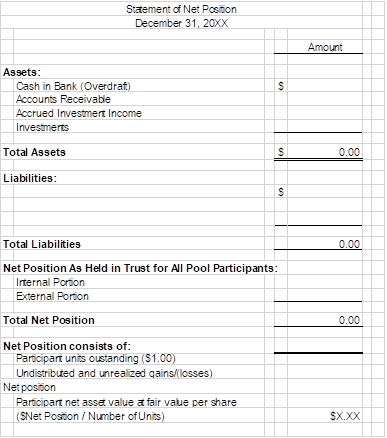

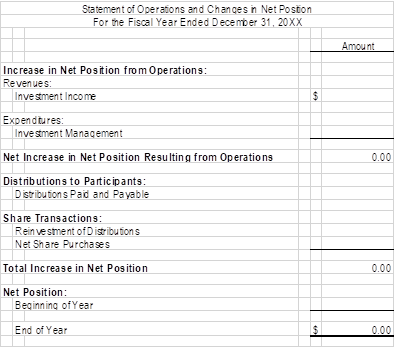

The External Investment Pool’s Statement of Net Position and Statement of Operations and Changes in Net Position as of and for the period ended December 31, 20XX, are as follows:

The pool values participant’s shares on an amortized cost basis. Specifically, the pool distributes income to participants on a quarterly basis based on their relative participation during the quarter that is calculated based on (1) realized investment gains and losses calculated on an amortized cost basis, (2) interest income based on stated rates (both paid and accrued), (3) amortization of discounts and premiums on a straight-line basis, and (4) investment and administrative expenses. This method differs from the fair value method used to value investments in these financial statements because the amortized cost method is not designed to distribute to participants all unrealized gains and losses in the fair values of the pool’s investments. The total difference between the fair value of the investments in the pool and values distributed to the pool participants using the amortized cost method described above is reported in the net position section of the net position section of the statement of fiduciary net position as undistributed and unrealized gains (losses). The external portion of the Pool is presented in the accompanying financial statements as “Held for external investment pool participants.”