Note X – Deposits and Investments

A. Deposits [1]

Custodial credit risk for deposits is the risk that, in event of a failure of a depository financial institution, the (city/county/district) would not be able to recover deposits or will not be able to recover collateral securities that are in possession of an outside party. The (city/county/district’s) deposits and certificates of deposit are mostly covered by federal depository insurance (FDIC) or by collateral held in a multiple financial institution collateral pool administered by the Washington Public Deposit Protection Commission (PDPC).

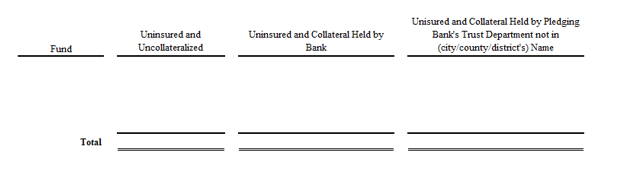

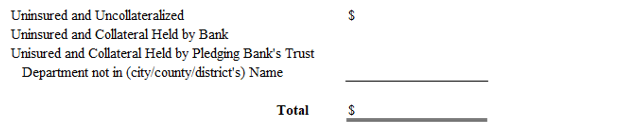

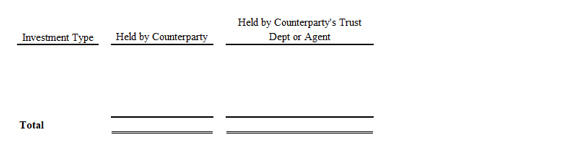

The (city/county/district) does not have a deposit policy for custodial credit risk. The bank balances that were exposed to custodial credit risks are:

-OR-

B. Investments [2]

It is the (city/county/district’s) policy to invest all temporary cash surpluses. The interest on these investments is prorated to the various funds (or if not prorated, explain your unique circumstances). [3]

Investments are subject to the following risks.

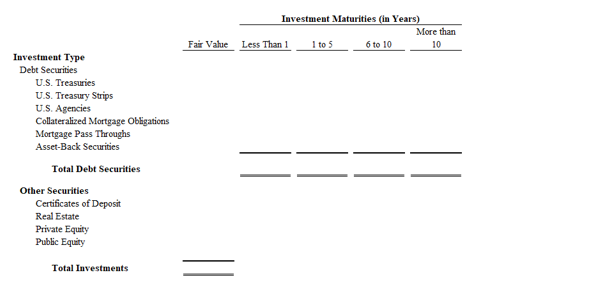

Interest Rate Risk: Interest rate risk is the risk the (city/county/district) may face should interest rate variances affect the fair value of investments. The (city/county/district) does not have a formal policy that addresses interest rate risk.

In addition to the interest rate risk disclosed above, the (city/county/district) includes investments with fair value highly sensitive to interest rate changes.

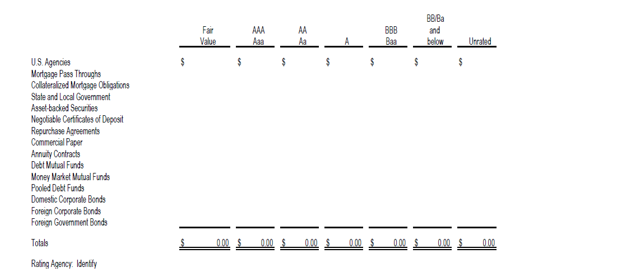

Credit Risk: Credit risk is the risk that an issuer or other counterparty to an investment will not fulfill its obligations. The (city/county/district) does not have a formal policy that addresses credit risk.

At December 31, 20__, (city/county/district’s) investments had the following credit quality distribution for securities with credit exposure:

Custodial Credit Risk: Custodial credit risk is the risk that, in the event of the failure of the counterparty, the (city/county/district) will not be able to recover the value of its investments or collateral securities that are in the possession of an outside party. The (city/county/district) does not have a formal policy for custodial credit risk.

Concentration of Credit Risk: Concentration of credit risk is the risk of loss attributable to the magnitude of an investment in a single issuer. The (city/county/district) does not have a formal policy for concentration of credit risk.

Investments in Local Government Investment Pool (LGIP)

The (city/county/district) is a voluntary participant in the Local Government Investment Pool, an external investment pool operated by the Washington State Treasurer. The pool is not rated and not registered with the SEC. Rather, oversight is provided by the State Finance Committee in accordance with RCW 43.250. Investments in the LGIP are reported at amortized cost, which is the same as the value of the pool per share. The LGIP does not impose any restrictions on participant withdrawals.

The Office of the State Treasurer prepares a stand-alone financial report for the pool. A copy of the report is available from the Office of the State Treasurer, PO Box 40200, Olympia, Washington 98504-0200, online at www.tre.wa.gov.

Investments in (county investment pool) [4]

The (city/county/district) is a participant in the (county investment pool), an external investment pool operated by the County Treasurer. The pool is not rated or registered with the SEC. Rather, oversight is provided by the County Finance Committee in accordance with RCW 36.48.070. The (city/county/district) reports its investment in the pool at (amortized cost / fair value), which is (the same as the value of the pool per share / or disclose the difference between the reported amount and the value of pool shares). (The pool does not impose any restrictions on participant withdrawals / disclose any liquidity fees, redemption gates or other restrictions).

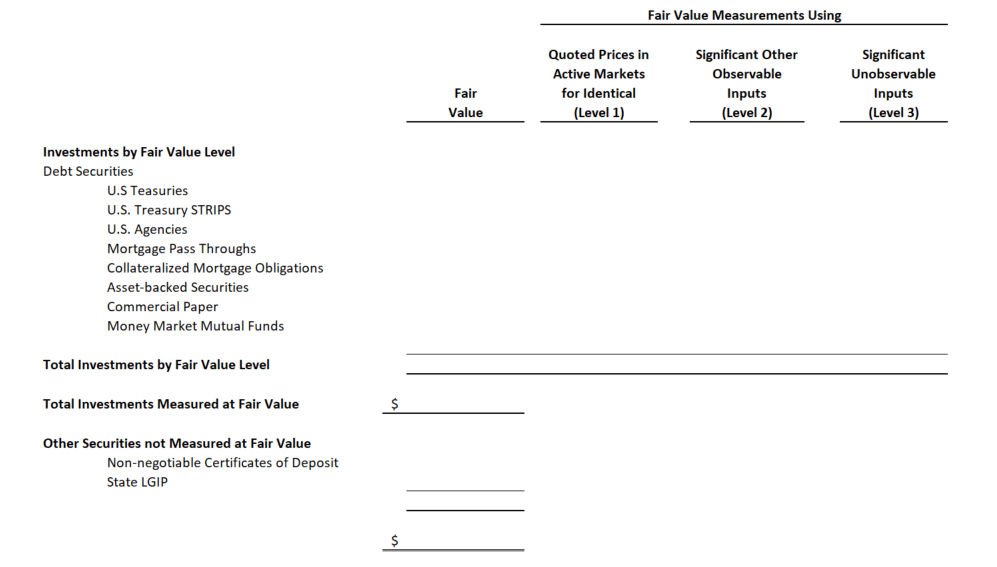

Investments Measured at Fair Value [5]

The (city/county/district) measures and reports investments at fair value using the valuation input hierarchy established by generally accepted accounting principles, as follows:

- Level 1: Quoted prices in active markets for identical assets or liabilities;

- Level 2: These are quoted market prices for similar assets or liabilities, quoted prices for identical or similar assets or liabilities in markets that are not active, or other than quoted prices that are not observable;

- Level 3: Unobservable inputs for an asset or liability.

At December 31, 20__, the (city/county/district) had the following investments measured at fair value:

Investments Measured at Net Asset Value (NAV) [6]

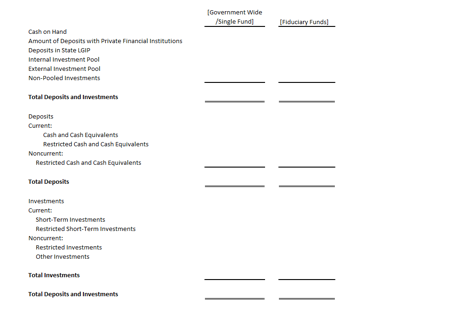

C. Summary of Deposit and Investment Balances [7]

Reconciliation of (city/county/district’s) deposits and investment balances as of December 31, 20__, is as follows:

D. Securities Lending [8]

E. Gains and Losses on Investments [9]

F. Foreign Currency Risk [10]

Foreign currency risk is the risk that changes in exchange rates will adversely affect deposits or investments. The (city/county/district) does not have a formal policy for foreign currency risk (or briefly describe the policy to manage or limit foreign currency risk). The exposure to foreign currency risk for deposits as of December 31, 20__ is as follows:

Instructions for preparer:

The city/county/district should briefly describe the types of investments authorized by legal and contractual provisions. If there are material violations of these provisions, they should be disclosed. If the types of investments authorized for different funds, fund types, or component units differ significantly from those authorized for the primary government and those funds, fund types, or component units have material investment activity compared with the combined primary government activity, the difference in the authorized investment types should be disclosed. The city/county/district should also disclose its own policies that are related to risks. If a city/county/district has no deposits or investments policy that addresses a specific type of risk that it is exposed to, the disclosure should indicate that fact.

This disclosure is required for a primary government as a whole. Risk disclosures should also be made for governmental and business/type activities, individual major funds, nonmajor funds in aggregate, or fiduciary fund types when the risk exposures are significantly greater than the deposit and investment risk of the primary government.

Disclosures should distinguish between the primary government and it’s discretely presented component units. The financial statements should make those discretely presented component unit disclosures that are essential to fair presentation of the basic financial statements.

Disclosure is limited to types of investment held at year-end.

[1] The following disclosures are required regarding cash deposits with financial institutions:

-

Legal and contractual provisions regarding deposits;

-

Policies governing deposits;

-

Exposure to custodial risk as of the date of the balance sheet or statement of net position;

-

Defaults and recovery of prior period losses

If the city/county/district has bank balances subject to custodial credit risk, provide a brief description of its deposit policies related to deposit custodial credit risk or state that it does not have a deposit policy for custodial credit risk. Disclose only that portion of the total bank balance that was subject to deposit custodial credit risk. If no bank balance was subject to deposit custodial credit risk, do not include a discussion of deposit custodial credit risk in Note 2.

Return to Reference 1

[2] The following general disclosures are required regarding investments:

-

Types of investments authorized by legal or contractual provisions (if types of investments authorized for different funds, fund types, blended component units, or discretely presented component units differ significantly from those authorized for the primary government and have material investment activity compared with the reporting entity’s investment activity, the differences in authorized investment types should be disclosed)

-

Significant violations during the period of legal or contractual provisions for investments and actions taken to address such violations

-

Description of investments policies that are related to the following risks:

-

Interest rate risk

-

Credit risk

-

Custodial credit risk

-

Concentration of credit risk

-

If applicable, provide disclosures for the following types of risk. If the city/county/district does not have any investments exposed to risks identified below, delete risk description. Risk disclosures applicable to investments should be reported separately by investment type.

-

Interest rate risk − information should be organized by investment type and amount using one of the following methods:

-

segmented time distribution

-

specific identification

-

weighted average maturity

-

duration

-

simulation model.

-

Any assumption made in process of applying these methods need to be disclosed.

Describe the highly sensitive investments. For additional information see the Governmental Accounting Standards Board (GASB) Statement 40, paragraph 16 and 57 (examples listed were asset-backed securities) and Illustration 7. Illustration includes CMO’s, inverse variable rate notes, and variable coupon note with multiplier as examples of investments with fair values highly sensitive to interest rate changes.

Governments that participate in a pooled arrangement (other than an external pools investment pool) should disclose interest rate risk for the pooling arrangement. This disclosure is limited to investments in debt mutual funds, external debt investment pools, or other pooled debt investments.

Governments should also disclose any contractual terms for debt investments that expose those investments to the risk of significant changes in fair value resulting from interest rate fluctuation (e.g., coupon multipliers benchmark indices, embedded options, etc.).

-

Credit risk - disclose credit ratings for investments in debt securities, whether held directly or indirectly including the credit ratings for positions in external investment pools. If a rating is not available, that fact should be disclosed. (This requirement does not apply to the debt securities of the U.S. government or obligations of the U.S. government agencies that are explicitly guaranteed by the U.S. government.) The city/county/district should use the various rating categories (e.g., AAA, Aaa, etc.) set by nationally recognized statistical rating organizations (e.g., Fitch Ratings, Moody’s Investor Services, Standard & Poor’s, etc.).

-

Custodial credit risk– disclose for investments only if unregistered/uninsured securities are held either by the counterparty or by the counterparty’s trust department or agent, but not in government’s name.

[Note: The Washington Public Deposit Protection Commission eased collateral requirements on uninsured public deposits under Resolution 2016-1, for public depositaries categorized as Well Capitalized as defined in Subsection (b)(a)(A) of Section 38 of the Federal Deposit Insurance Act (FDIA) or hereafter amended and as determined by federal regulatory authority for that public depositary, may collateralize uninsured public deposits at no less than fifty percent. All public depositaries not categorized as Well Capitalized as defined in Section 38 of the FIA are required to fully collateralize uninsured public deposits pursuant to Resolution 2009-1.]

-

Concentration of credit risk - disclose amount and issuer of investments that represents 5 percent or more of total investments. (This requirement does not apply to investments issued or explicitly guaranteed by the U.S government and investments in mutual funds, external investment pools, and other pooled investments.)

In addition, governments should make the following disclosures in the notes to the financial statements:

-

the policy for determining which investments, if any, are reported at amortized cost;

-

for any investments in external investment pools that are not SEC-registered, a brief description of any regulatory oversight for the pool and whether fair value of the position in the pool is the same as the value of the pool shares;

-

any involuntary participation in an external investment pool;

-

if an entity cannot obtain information from a pool sponsor to allow it to determine the fair value of its investment in the pool, the methods used and significant assumptions made in determining that fair value and the reasons for having had to make such an estimate;

-

for any investments in external investment pools that report their investments at amortized cost in accordance with the GASB Statement 79, the presence of any limitations or restrictions on withdrawals (such as notice periods, maximum transaction amounts, and the qualifying external investment pool’s authority to impose fees or redemption gates);

-

any income from investments associated with one fund that is assigned to another fund.

Governments should disclose policies relevant to each of different types of risks, but only for those types of risks actually faced by the government. If a government does not have a policy that covers one or more of the risks it is facing, that fact must be disclosed.

For more information see GASB Statements 3, 28, 31, 40, 59 and 72.

Return to Reference 2

[3] Disclose any income from investments associated with one fund that is assigned to another fund. See BARS Manual 3.2.3, Sweeping Interest and Investment Returns into General Fund for legal requirements related to interest diversion.

Return to Reference 3

[4] This applies only to PARTICIPANTS in investment pools (For Sponsoring a County investment pool see Note X – External Investment Pool (Counties Only) and BARS Manual 3.2.2, County External Investment Pool).

Participants in external investment pools must disclose:

-

For pools that are not SEC-registered, a brief description of any regulatory oversight for the pool and whether fair value of the position in the pool is the same as the value of the pool shares.

-

Whether participation is voluntary or involuntary.

-

Whether investments in the pool are reported at amortized cost or fair value.

-

For pools reported at amortized cost, any limitations or restrictions on withdrawals from external investment pools (such as redemption notice periods, maximum transaction amounts, and the external investment pool’s authority to impose liquidity fees or redemption gates).

If the government cannot obtain information from a pool sponsor to make one or more disclosures, the government’s understanding of the pool should be disclosed along with the fact that the government was unable to obtain confirmation from the pool about this understanding. See GASB Statement 79, Certain External Investment Pools and Pool Participants, paragraphs 42 and 43 for details.

Return to Reference 4

[5] Investments should generally be reported at their fair value. If there are no such investments, this section should be deleted.

-

Fair value measurement at the end of the reporting period,

-

Level of fair value hierarchy,

-

A description of the valuation techniques used,

-

For any significant changes in valuation techniques, the changes and the reason for making them.

Disclosure is required for the reason for any nonrecurring measurements.

Disclosure should be organized by type of investment. Appropriate grouping by type is a professional judgement based on:

-

Nature, characteristics and risks of the asset or liability,

-

Level of fair value hierarchy within which the fair value measurement is categorized,

-

Whether standards specify a type for an asset or liability,

-

Identifying transactions that are not orderly,

-

Objective or the mission of the government,

-

Characteristics of the government,

-

Relative significance of assets and liabilities,

-

Whether separately issued financial statements are available,

-

Line items presented in the statement of net position.

However, governments have the option of reporting certain investments at cost or amortized cost. For example, investments held by external investment pools meeting requirements of GASB Statement 79, Certain External Investment Pools and Pool Participants, and money market investments and participating interest-earning investment contracts with a remaining maturity at time of purchase of one year or less, provided that the fair value is not significantly affected by credit impairments or other factors.

Level 1 inputs

Level 1 inputs are quoted (unadjusted) prices in active markets for identical assets or liabilities that the government can access at the measurement date. Observable markets include exchange markets, dealer markets, brokered markets and principal-to-principal markets.

Level 2 inputs

These are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. Inputs are derived from or corroborated by observable market data through correlation or by other means.

-

Quoted prices for similar assets or liabilities in active markets,

-

Quoted prices for identical or similar assets or liabilities in inactive markets,

-

Inputs other than quoted prices that are observable for the asset or liability, such as:

-

Interest rate and yield curves observable at commonly quoted intervals

-

Implied volatilities

-

Credit spreads

-

-

Market-corroborated inputs.

Level 3 inputs

Unobservable inputs for the asset or liability; only should be used when relevant Level 1 and 2 inputs are unavailable. Government may use their own data to develop unobservable inputs if there is no information available.

The SSAP should indicate whether the government used this option and, if so, for which one specific categories of investment. Also, if a government uses some other than quoted market prices to estimate the fair values, the methods and significant assumptions should be disclosed.

Note: Governments using a pricing service or custody bank for fair values will need closely review statement to ensure valuation changes are correctly reported.

Determine what the source of the fair value information will be for each item. Do not simply rely on the fair value reported to you on monthly bank statement or brokerage statements. Contact the financial institution to understand how they determine fair value.

Example:

If there are derivatives investments identified as hedging instruments, an additional disclosure is required per GASB Statement 53, Accounting and Financial Reporting for Derivative Instruments (amended by GASBS 64).

[6] Investments Measured at Net Asset Value (NAV)

A government can use NAV per share, as a practical expedient, for investments in nongovernmental entity that does not have a readily determinable fair value (also known as “alternative investments”). The NAV is not permitted for valuation if it is probable the government will sell the investment at a different price. Investments measured at NAV would be excluded from the fair value hierarchy (Level 1, 2, or 3). Note: Investment pools containing language for NAV at fair value or amortized cost should be reported in accordance with other investments at fair value or amortized cost, and not as investments using NAV as a practical expedient.

Alternative investments measured using NAV require additional disclosure for financial statement users to understand the investment’s nature and risks due to the increased uncertainty and subjectivity of the investment and whether such investments are likely to be sold at an amount different from NAV per share. The required disclosure includes:

-

Fair value measurement of the investment type and description of the significant investment strategies;

-

For investments that can never be redeemed with the investees, the government’s estimate of the liquidation period;

-

Amount of unfunded commitments;

-

General description of the redemption terms and conditions;

-

Redemption restrictions, estimate of length of restriction period or how long restriction has been in place;

-

Any other selling restrictions;

-

Fair value of investments for any planned sales at an amount different from NAV per share and any remaining actions required to complete the sale;

-

If a sale is planned but not all assets have been identified, the government’s plans to sell and any remaining actions required to complete the sale.

[7] Optional disclosure for cash and investments reconciliation. There is no requirement to reconcile the disclosures required for cash equivalents or deposits and investments to the statement of cash flows or to the statement of net position/balance sheet. Many of the deposits and investments that are subject to disclosure requirements may be reported in the statement of net position/balance sheet as cash and cash equivalents. Other may be reported in the statement of net position/balance sheet using titles that do not identify their nature as deposits and investments. Disclosure of such reconciliation can provide useful information to the users of the financials.

Return to Reference 7

[8] If in the period covered by the financial statements, the city/county/district participated in the securities lending transactions, the following information should be disclosed:

-

legal or contractual authorization for the securities lending transactions;

-

significant violations of legal and contractual provisions during the period;

-

actions taken to address such violations;

-

general description of the securities lending transactions:

-

type of securities lent,

-

type of collateral received,

-

whether the government has the ability to pledge or sell collateral securities without a default,

-

the amount by which the value of the collateral provided is required to exceed the value of underlying securities,

-

any restrictions on the amount of the loans that can be made,

-

any loss indemnification (i.e., a securities lending agent’s guarantee that it will protect the lender from certain losses);

-

-

fair values of underlying securities at the balance sheet date;

-

whether the maturities of the investments made with cash collateral generally match the maturities of their securities loans, as well as the extent of such matching at the balance sheet date;

-

the amount of credit risk, if any, related to the securities lending transactions (if the lender has not credit risk, that fact should be stated);

-

the amount of any losses on the securities lending transactions during the period resulting from the default of a borrower or lending agent and amounts recovered from prior period losses, if not separately disclosed in the operating statement.

Securities lending transactions are subject to custodial risk disclosure requirements addressed in paragraph 9 of GASB Statement 40, Deposits and Investments Risk Disclosures. See paragraph 10 of the above statement for applicability of this disclosure.

(For more details, see the GASB Statement 28, Accounting and Financial Reporting for Securities Lending Transactions as amended by the GASB Statement 40, Deposits and Investments Risk Disclosures.)

Return to Reference 8

[9] Local government may disclose realized gains and losses computed as the difference between the proceeds of the sale and the original cost of the investments sold. They also should disclose that:

a. The calculation of realized gains and losses is independent of a calculation of the net change in the fair value of investments.

b. Realized gains and losses on investments that had been held in more than one fiscal year and sold in the current year were included as a change in the fair value of investments reported in the prior year(s) and the current year.

For more details, see the GASB Statement 31, Accounting and Financial Reporting for Certain Investments and for External Investments Pools, as amended by the GASB Statement 40, Deposits and Investments Risk Disclosures.

Return to Reference 9

[10] If applicable, disclose the U.S. dollar value of any deposits or investments denominated in foreign currency, organized by each different foreign currency denomination and type of investment.

Return to Reference 10