4 Reporting

4.2 Government-Wide Financial Statements

4.2.8 Net Position

4.2.8.10 The difference between (1) assets and deferred outflows of resources, and (2) liabilities and deferred inflows of resources is called net position. Net position should be displayed in three categories which focus on the accessibility of the underlying assets:

- Net investment in capital assets

- Restricted

- Unrestricted

Net investment in capital assets

4.2.8.20 The net investment in capital assets category of a government’s net position represents the investment in capital assets, net of capital asset related items. The amount should be calculated as follows:

- Capital asset balances in the statement of net position (including restricted capital assets, tangible and intangible capital assets),

- Minus accumulated depreciation (if capital assets are not reported net), and

- Minus outstanding balances of capital related bonds, mortgages, notes, or other debt and liabilities that are attributable to the acquisition, construction, or improvement of those assets. (This includes capital-related retainage and accounts payable, as well as premiums and discounts on bonds. This balance excludes unspent debt proceeds.),

- Minus deferred inflows of resources that are capital related (e.g., gain on refunding of outstanding capital-related debt), and

- Plus deferred outflows of resources that are capital related (e.g., loss on refunding of outstanding capital-related debt).

All capital assets should be reported as Net Investment in Capital Assets, regardless of restrictions but they should not include any financial resources restricted for capital assets acquisition, construction, or improvement (e.g., unspent bond proceeds, grant monies, etc.) or financial resources held for capital assets acquisition, construction, or improvement. The unspent resources would be reported as Restricted or Unrestricted components of net position, depending on the constraints on these financial resources.

4.2.8.30 If part of the debt proceeds were spent on assets that have been not capitalized or other non-capital purposes (assuming that part is immaterial), the entire amount of debt should be considered capital related. If the amount spent on non-capitalized purposes is material, this amount should be removed from the debt outstanding balances calculation.

If a part of the debt proceeds was spent to establish a debt service reserve fund, this amount should be removed from the debt outstanding balances calculation.

Capital asset related debt should include debt issued to refund existing capital related debt.

If one government issued debt to finance the capital assets of another government, this debt should not reduce the Net Investment in Capital Assets unless the capital assets are also reported by the government issuing debt. If the assets are not reported by the government issuing the debt, the debt should be reported in the Restricted or Unrestricted component of net position, depending on the constraints on the financial resources. If the amount is significant, the government should disclose details about the transaction in the notes to the financial statements.

The amounts of unspent bond proceeds at the year-end should be reported as an increase of Restricted or Unrestricted component of net position, depending on the constraints on the these financial resources, not as a reduction of Net Investment in Capital Assets, as these amounts should already be excluded from the outstanding principal of capital-related borrowings.

If there is no capital related debt, the line should be labeled Investment in Capital Assets.

4.2.8.31 The net investment in capital assets should be calculated as follows:

Restricted component of net position

4.2.8.40 Components of net position should be reported as restricted when constraints placed on its use are either:

- Externally imposed by creditors (such as through debt covenants), grantors, contributors, or laws or regulations of other governments, or

- Imposed by law through constitutional provisions or enabling legislation.

The constraints placed on the use of the asset must, in addition to the above criteria, be narrower than the purpose of the reporting unit:

- Governmental activities: the reporting unit for this criteria is the governmental activities column on the Statement of Net Position.

- Business-type activities: the reporting unit for this criteria is the individual enterprise fund.

4.2.8.50 Designation in the management’s plan for the use of the resources is not equivalent to enabling legislation. Enabling legislation refers to a situation when a government passes a law that gives them the ability to levy tax or otherwise raise revenues and includes a legally enforceable requirement that those resources be used for the specific purpose stipulated in the law.

4.2.8.60 Restricted net position consists of restricted assets reduced by liabilities and deferred inflows related to those assets. The government must distinguish between major categories of restrictions (e.g., restricted for debt service, restricted for capital projects capital, etc.), details about the restricted net position should not be displayed on the face of the statement and should be disclosed in the notes to the financial statements. If there are permanent funds, this component of the restricted net position should also be displayed as expendable and nonexpendable.

See BARS 3.4.2, Pensions for information on how to calculate the restricted net position related to net pension assets.

4.2.8.70 The restricted net position of governmental activities may not be equal to restricted fund balances in the governmental funds. The reasons are: different measurement focus and different basis of accounting.

4.2.8.80 No category of restricted component of net position can be negative, if liabilities related to restricted assets exceed those assets, no balance should be reported. The negative amount should be reported as reduction of unrestricted component of net position.

Unrestricted component of net position

4.2.8.90 The unrestricted component of net position is the net amount of the assets, deferred outflows of resources, liabilities, and deferred inflows of resources that are not included in the determination of net investment in capital assets or the restricted components of net position. Designations should not be reported on the face of the statement, but the details can be disclosed in the notes to the financial statements.

4.2.8.100 It is possible that the unrestricted component of net position may be a negative number (e.g., significant balances of noncurrent operating liabilities such as compensated absences, net pension liabilities, non-capital related debt, etc.).

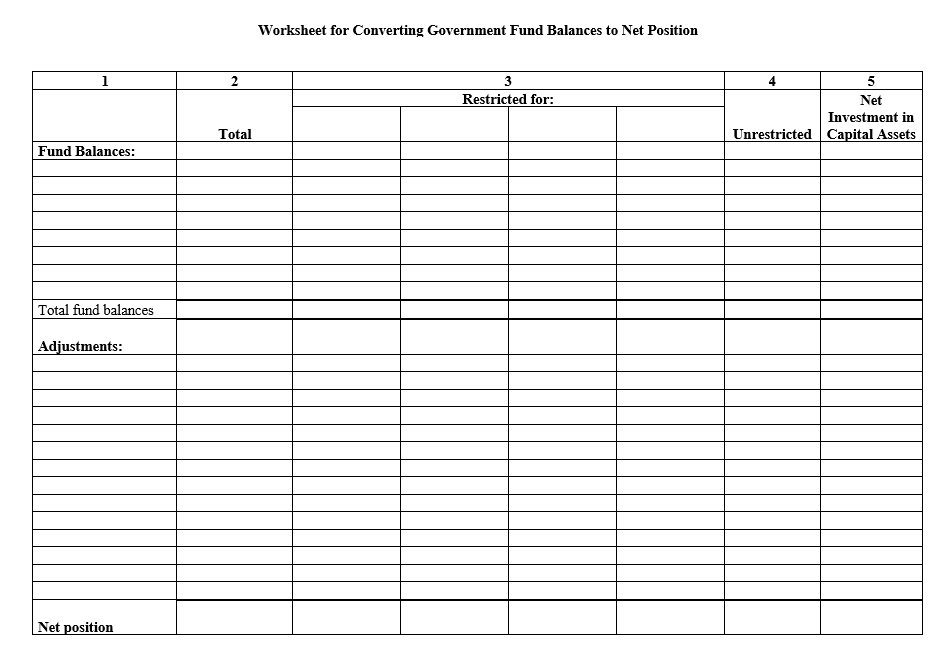

4.2.8.110 The government may use the following worksheet to convert the governmental fund balances to net position. The worksheet is easier to use after the fund financial statements are completed.

- Columns one and two list the funds and their balances. This information will come from the fund financial statements.

- Column three lists the major categories of restrictions. Allocate the fund balances to appropriate restriction category (make sure that the amounts posted here meet the government-wide financial statements’ definition of restricted assets).

- Column four includes all amounts that are not restricted.

- Column five contains the information from the government’s capital assets and long-term debt records and can be calculated as described in 4.2.8.31.