4 Reporting

4.3 Fund Financial Statements

4.3.2 Major Funds

4.3.2.10 The governmental and proprietary fund financial statements have to provide financial information for each major fund in a separate column. Major funds represent the government’s most important funds and are determined by a mathematical calculation. However, governments should avoid an overly mechanical approach and try to identify the individual funds that are most important to users. To determine which funds, in addition to those, which must be reported as major, are of particular importance or interest to the users, the governments should consider factors like:

- Political/social sensitivity of the activities financed from that fund.

- Impact or potential impact of that fund on other programs or services.

- Significance of that fund on financing activities which are of high interest to public.

- Existence of known uses or users of that information (e.g., bond rating companies, investors, etc.).

- Relative size (without regard to the Governmental Accounting Standards Board (GASB) Statement 34 limits).

- Year-to-year consistency in reporting, etc.

4.3.2.20 The general (current expense) fund is always reported as a major fund. Major funds reporting only applies to governmental and enterprise funds. It does not apply to internal service or fiduciary funds. The determination of which funds are major must be made each fiscal year.

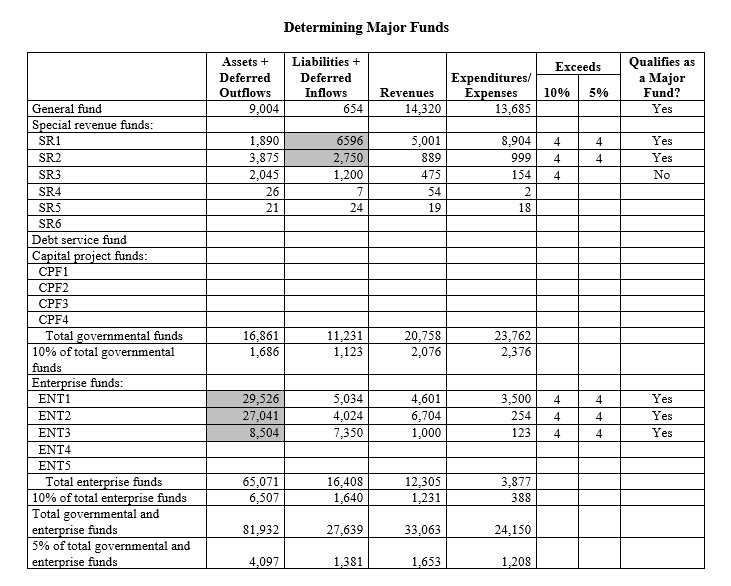

4.3.2.30 Governmental and enterprise funds are required to be reported as major funds if they meet the following criteria:

- Total assets plus deferred outflows of resources, liabilities plus deferred inflows of resources, revenues, or expenditures/expenses [1] of that individual governmental or enterprise fund are at least ten percent of the corresponding element total (assets, liabilities, etc.) for all funds of that category [2] or type [3] (either total governmental or total enterprise), and

- The same element that met the above ten percent intention is at least five percent of the corresponding element total for all governmental and enterprise funds combined.

4.3.2.40 However, before using the spreadsheet remember:

- They have to meet both of the criteria above to be required to be reported as a major fund.

- No elimination of interfund balances is necessary in order to apply the criteria unless there are some significant amounts of interfund payables and receivables, then those can be netted.

- Total revenues means all revenues - both operating and nonoperating revenues of enterprise funds, including capital contributions except for other financing sources (governmental funds), transfers in and gains from the extraordinary items.

- Total expenditures/expenses means all expenditures or expenses – both operating and nonoperating except for other financing uses (governmental funds), transfers out and losses from the extraordinary items.

- The test should be applied to the GAAP amounts reported in the funds financial statements.

4.3.2.50 If there are no major enterprise funds, they all should be reported in one column and the second column would show the internal service fund(s). For more details see BARS Manual 4.3.4, Proprietary Funds Financial Statements.

4.3.2.60 Internal service funds are reported in a single column on the face of the proprietary fund financial statements to the right of the enterprise funds. For more details see BARS Manual 4.3.6, Internal Service Funds.

4.3.2.70 Fiduciary funds are to be reported in the fund financial statements by fund type (e.g., pension, investment trust, private purpose, and custodial funds). For more details see BARS Manual 4.3.5, Fiduciary Funds Financial Statements.

Nonmajor funds

4.3.2.80 Nonmajor funds should be aggregated and reported in a single column to the right of the major funds in the financial statements. It is not permitted to use more than one column for nonmajor funds. Interfund transactions and balances may be, but are not required to be, eliminated when nonmajor funds are combined.

Combining statements for the nonmajor funds are not required, but may be presented as supplementary information.

Footnotes:

[1] These amounts apply for the year being reported. Do not use prior year data.

Back to Reference 1

[2] “. . . all funds of that category” means all governmental funds, including the general fund.

Back to Reference 2

[3] “. . . all funds of that type” means all enterprise funds.

Back to Reference 3