Note X – Joint Ventures, Component Unit(s), and Related Parties

A template is not provided since each situation is unique. The instructions below provide information on what should be included in the note disclosure.

Instructions to preparer:

Joint ventures, Component units and foundations:

The notes should provide the following information for any legally separate organization that the government controls or participates in joint control (e.g., because it appoints one or more members of the board), holds an ongoing financial interest or financial responsibility, or that is a foundation dedicated to benefiting the government:

-

Description of the Component Unit/Joint Venture; such as:

-

date of formation,

-

governing body, who oversees the management of the organization,

-

the purpose of the component unit/joint venture, why the organization was formed.

-

-

Information regarding the nature of the relationship with the government.

-

Information regarding the performance and activity of the organization by providing financial information such as:

-

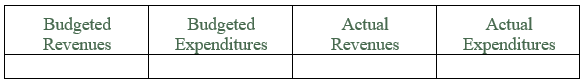

Operating budget – budgeted revenues and expenditures

-

Operating actuals – actual revenues and expenditures

-

If applicable, any amounts remitted to or received from the joint venture / component unit.

-

-

Provide other information that may be of interest or benefit to the users of the financial statements; such as if separate financial statements are provided, how to obtain more information, etc.

Sample note:

(Each situation is unique, this sample may not provide complete disclosure of the component unit or joint venture; adjust the note as necessary.)

The (component unit/joint venture) was formed by (ordinance/vote of the citizens/etc.) of (county/city/district). The (component unit/joint venture) provides (purpose of formation, function, activity) for the (county/city/district/etc.). The (component unit/joint venture) is governed by a (number of officials) board composed of (appointed/voted) by the (county/city/district's) citizens.

The (County/City/District) is/isn’t obligated to (provide nature of relationship, such as required funding from County/City/District, support for component unit/joint venture operations, revenue or net income sharing arrangements, etc. If applicable, provide information on who receives assets of the component unit/joint venture upon dissolution).

In 20__ the (component unit/joint venture) remitted/received $___________ to/from the (county/city/district). The (component unit/joint venture) also reported the following:

The financial statements for the (component unit/joint venture) can be obtained at (address/website).

Related party:

These disclosures are required for any significant transactions with related parties, other than normal transactions conducted in the ordinary course of operations (such as compensation of employees or licensing or permitting for other governments). When evaluating the necessity of a disclosure, governments should consider both the form and substance of the transaction.

Related parties include:

-

A government's joint ventures, component units and foundations

-

Elected and appointed officials of the government, executive management and immediate family members of officials and executive managers

-

Other parties that the government can significantly influence

-

Other parties that can significantly influence the government

-

Other parties that are under the influence of a related party to the government

Disclosure should include (for each period for which financial statements are presented):

-

The nature of the relationship(s) involved.

-

A description of the transactions, including transactions with nominal or no amounts and other information deemed necessary to gain an understanding of the effects of the transactions on the financial statements.

-

The dollar amounts of transactions and the effects of change in the method of establishing the terms used in the preceding period.

-

Amounts due from or to related parties and, if not otherwise apparent, the terms and manner of settlement.