3 Accounting

3.2 Assets

3.2.4 Money Held in Trust

Deposits

3.2.4.10 Governments may require deposits from customers. For example:

- A housing authority may require deposits in relation to public housing activities.

- A public utility may require deposits from its customers for either initial or restoration services, provided the deposits are reasonable and not discriminatory.

3.2.4.20 Governments should enact policies addressing investment and disposition of interest on deposits by considering legal and contractual requirements and public policy. Governments are encouraged to disclose such policies in applications and official documents related to deposits to ensure a clear mutual understanding of such policies with depositors.

Investment of superior court trust funds

3.2.4.50 Pursuant to RCW 36.48.090, whenever the clerk of the superior court has moneys held in trust for any litigant or for any purpose, they should be deposited in a separate bank account designated Court Trust Fund. These moneys should not be commingled with any public funds. The clerk is subject to the same investment limitations as the county treasurer (RCW 36.29.020). See Sweeping Interest and Investment Returns into General Fund.

Interest income

3.2.4.60 Unless provided otherwise, interest earned on trust investments should be forwarded to the county treasurer as current expense fund revenue. If however, the trust principal amounts to $2,000 dollars or more and a litigant in the matter had filed a written request, the interest should be held in trust and paid to the beneficiary upon termination of the trust. The clerk should assess a five percent investment service fee, subject to statute limitations, on interest earned on behalf of beneficiaries.

3.2.4.70 All litigants not represented by an attorney and who have $2,000 dollars or more being held by a superior court clerk should receive written notice of the provision for receiving interest income on the funds.

Accounting requirements

Clerks making trust fund investments must maintain an investment ledger and reconcile the ledger to bank and investment account statements and the county general ledger on a monthly basis. The investment ledger must:

(1) Be sufficient to indicate the total amount of funds invested at any given time (a control account).

(2) List each investment purchased by purchase date, trust account check number or EFT number, description of investment and identification (passbook or CD number, financial institution holding investment, interest rate, maturity date, etc.) and purchase price.

(3) Show for each investment sold: total proceeds, interest due the current expense fund, interest due to other recipients, sales date, clerk’s receipt number, and investment fee.

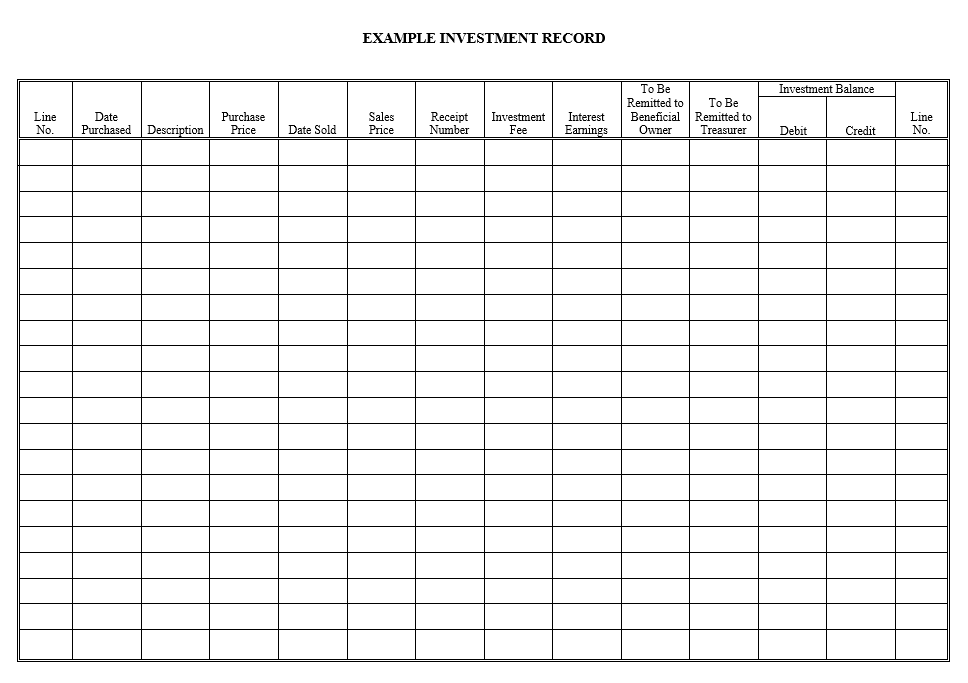

(4) Maintain individual records for each case as part of the ledger either as part of the investment ledger or as periodically reconciled to the investment ledger. Records should contain the name, address, case number, investment balance and accrued interest. An example record layout is provided on the following page.

3.2.4.90 Investment interest earnings remitted to the current expense fund and investment service fees deducted from interest due to others should be coded to the revenue account. Moneys to be paid to the county treasurer should be remitted each month together with other remittances.

3.2.4.100 Interest paid to litigants may need to be reported to the Internal Revenue Service. Governments should contact the IRS Federal, State and Local Government Division if tax advice is needed.