The Audit Connection Blog

Maximize your accounts receivable revenue with SAO’s new resources

From accurate and prompt billing to well-designed collection procedures, accounts receivable requires a robust set of internal controls to ensure your government collects the money it is owed. A strong accounts receivable process can result in higher revenue for your government, while a weak process can lead to wasted staff time, accounting errors and lost revenue. When was the last time you took a close look at your accounts receivable? ... CONTINUE READING

Rural County Sales and Use Tax For Public Facilities Report (fiscal year 2021) Now Online

Information the Office of the Washington State Auditor collects about rural counties' sales and use tax for fiscal year 2021 can be found in this Rural County and Sales Tax for Public Facilities Report – FY2021. SAO collects this data using a Schedule 20, which summarizes how counties use these funds and demonstrate their compliance with state law. Counties submit their Schedule 20 with their annual report, which is due to the State Auditor's Office 150 days after the close of their fiscal year. ... CONTINUE READING

Mark your calendars: Annual reports are due May 30

Spring is here and so is the annual report filing season. This year's deadline is May 30 for all governments with a Dec. 31 year-end. We encourage you to submit your government's annual report by the deadline. Timely filing ensures local governments comply with state law, and it demonstrates our shared commitment to accountability and transparency in government. ... CONTINUE READING

New Washington state law increases data access for use of audits into investigations of police use of deadly force

The State Auditor's Office is the first in the nation to routinely audit investigations of police use of deadly force by comparing them to state rules and professional best practices. This past week, Gov. Jay Inslee signed legislation to give auditors greater access to information in that work. The Legislature previously approved HB1179, authorizing the State Auditor's Office to access specific law enforcement data – criminal history records not associated with a conviction – as part of a use of deadly force investigation audit. ... CONTINUE READING

Protect your vendor master file from fraudsters

Automated Clearing House (ACH) and other types of payment fraud are on the rise, and bad actors are using vendor master files to do it. It starts with a simple request to change a vendor's contact information, payment address or banking details, and ends it with thousands or even millions of dollars in public funds being redirected to fraudulent accounts. ... CONTINUE READING

Summary infographic of Washington’s 2022 Annual Comprehensive Financial Report

Download a PDF version of the 2022 ACFR summary infographic. ... CONTINUE READING

Cybersecurity Special Report 2023: Roundup of 2022 audits and other work

Washington’s state and local governments possess countless IT systems that provide critical government services and handle vital and sometimes very personal data. The public expects government to do all it can to ensure that these systems are secure to ensure services are not interrupted, and stored data is not lost, stolen or damaged. ... CONTINUE READING

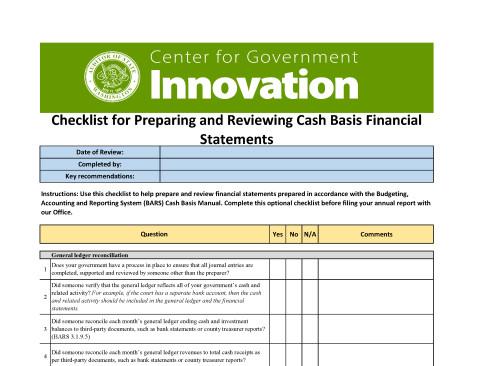

Preparing your cash basis annual report package? Check out SAO’s updated checklist

We know that preparing your annual report takes a lot of time and effort, especially when there are significant BARS changes. That’s why we created a Checklist for Preparing and Reviewing Cash Basis Financial Statements. ... CONTINUE READING

Washington’s agricultural commissions effective, can do more, audit finds

Local agricultural industry producers believe they benefit from the state commissions that promote commodities from cranberries to beef, and Washington should consider a statewide brand for its homegrown goods, according to a new performance audit by the Office of the Washington State Auditor. ... CONTINUE READING

More Washington governments accountable to the public in 2022

In 2022, just one new local government fell into unauditable status and three others were removed from the category, continuing progress toward accounting for the public finances of all of Washington’s 2,300 local governments. ... CONTINUE READING